Lending & Mortgages

- Construction Loans & Mortgages

- Foreclosure & Power of Sale

- Mortgage Investment Corporations

- Mortgage & Loan Enforcement

- Mortgage Syndications

- Private Equity & Venture Capital

Notice of Use of Proceeds 45-106F16 and the Offering Memorandum Exemption

What is Form 45‑106F16 & Why It’s Required Form 45‑106F16 is the Notice of Use of Proceeds that non‑reporting issuers relying on the Offering Memorandum (OM) exemption under NI 45‑106...

The Complexities of the Offering Memo Exemption, Ongoing Requirements and Pitfalls

Offering Memorandum Exemption under NI 45‑106 (Ontario) Eligibility & Purpose NI 45‑106 section 2.9 allows non‑reporting issuers to raise capital from the public via an Offering Memorandum (OM) distributed to...

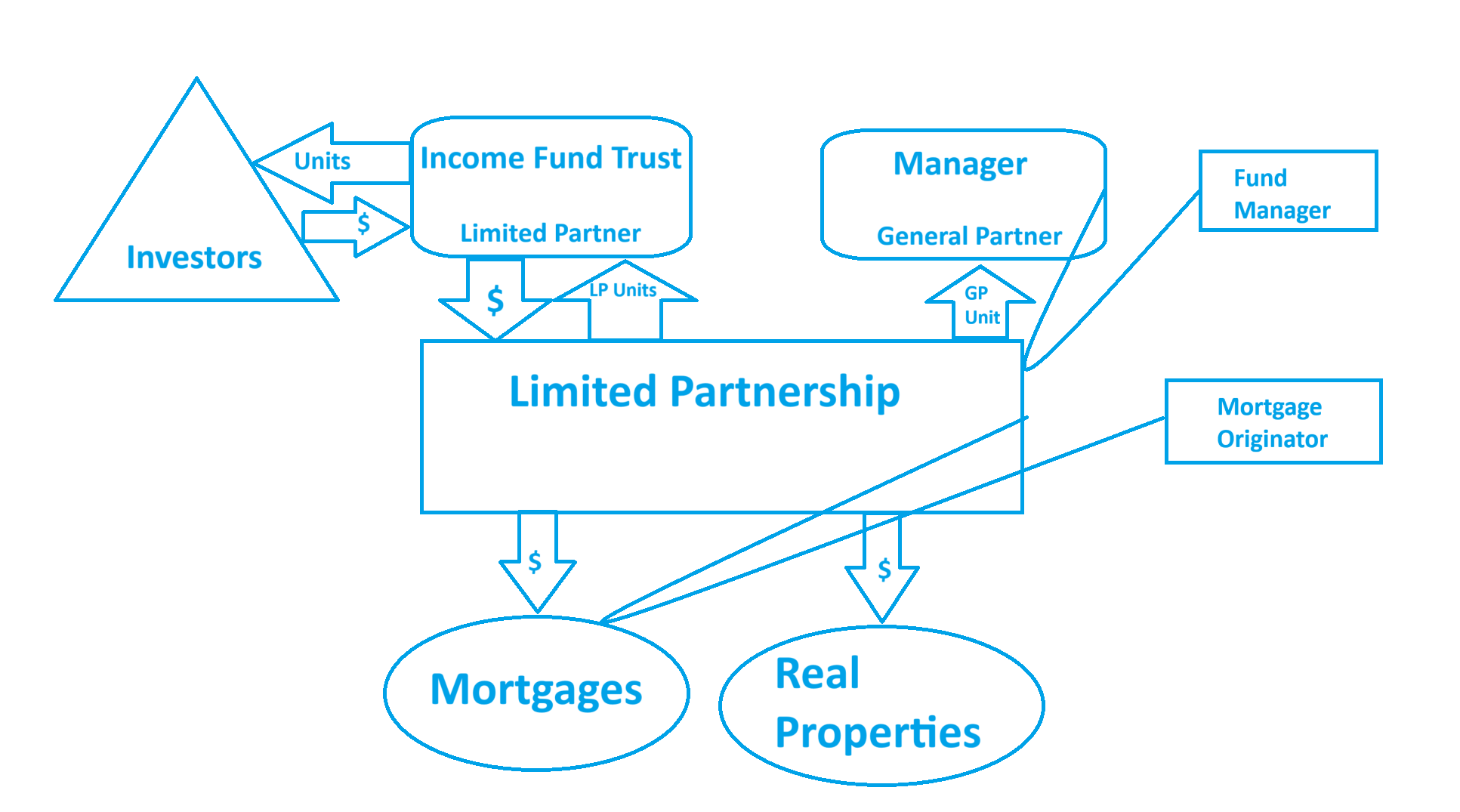

Mortgage Income Fund Trusts and Limited Partnerships

A Mortgage Income Fund Trust could be established to give investors an opportunity to invest, indirectly through units of a trust, in Canadian mortgages and other...

Do you need to do a SEDAR filing every month when issuing shares under a DRIP or other Reinvestment Plan?

Do you need to do a SEDAR filing every month when issuing shares under a DRIP or other Reinvestment Plan? Short Answer: NO so long as you...

Do MICs need to file an exempt distribution report for shares issued under a DRIP?

Should a Mortgage Investment Corporation ("MIC"), include exempt distributions of shares or other securities issued under a reinvestment plan (i.e. a DRIP or Dividend Reinvestment Plan),...

Example letter to shareholders on deferring dividends from your MIC until year-end

This letter is to inform you that we are deferring the regularly scheduled dividend until the financials for the year end are completed and audited, which...

Can a lawyer act for both the lender and borrower?

In most conventional cases where the mortgage is not a "private" mortgage or loan transaction, there are no hard rules rather than good judgement and a...

What to Know About Buying a Foreclosed Home in Ontario?

When you’re looking to buy a home, you may often come across a home for sale that is under foreclosure. These properties are usually identified by...

How to rely on the available exemptions in the Province of Ontario from the requirements to be licensed under the Mortgage Brokerages, Lenders and Administrators Act.

In Ontario, Dealing, Trading, Lending and Administering mortgages are all regulated activities, which requires licensing under the Mortgage Brokerages, Lenders and Administrators Act (the “Act”), as...

Registering a Notice to try and save a Power of Sale

Often, borrowers loosing their home to a power of sale will take any advise they can get to stop the process. Borrowers are sometimes led to...