Tag: income tax act

Tag: income tax act

Condo Builders Leasing Units Triggers HST Self-Supply

This article is not intended to provide any accounting or tax advice, but merely to illustrate to condo builders some serious consequences of leasing their inventory...

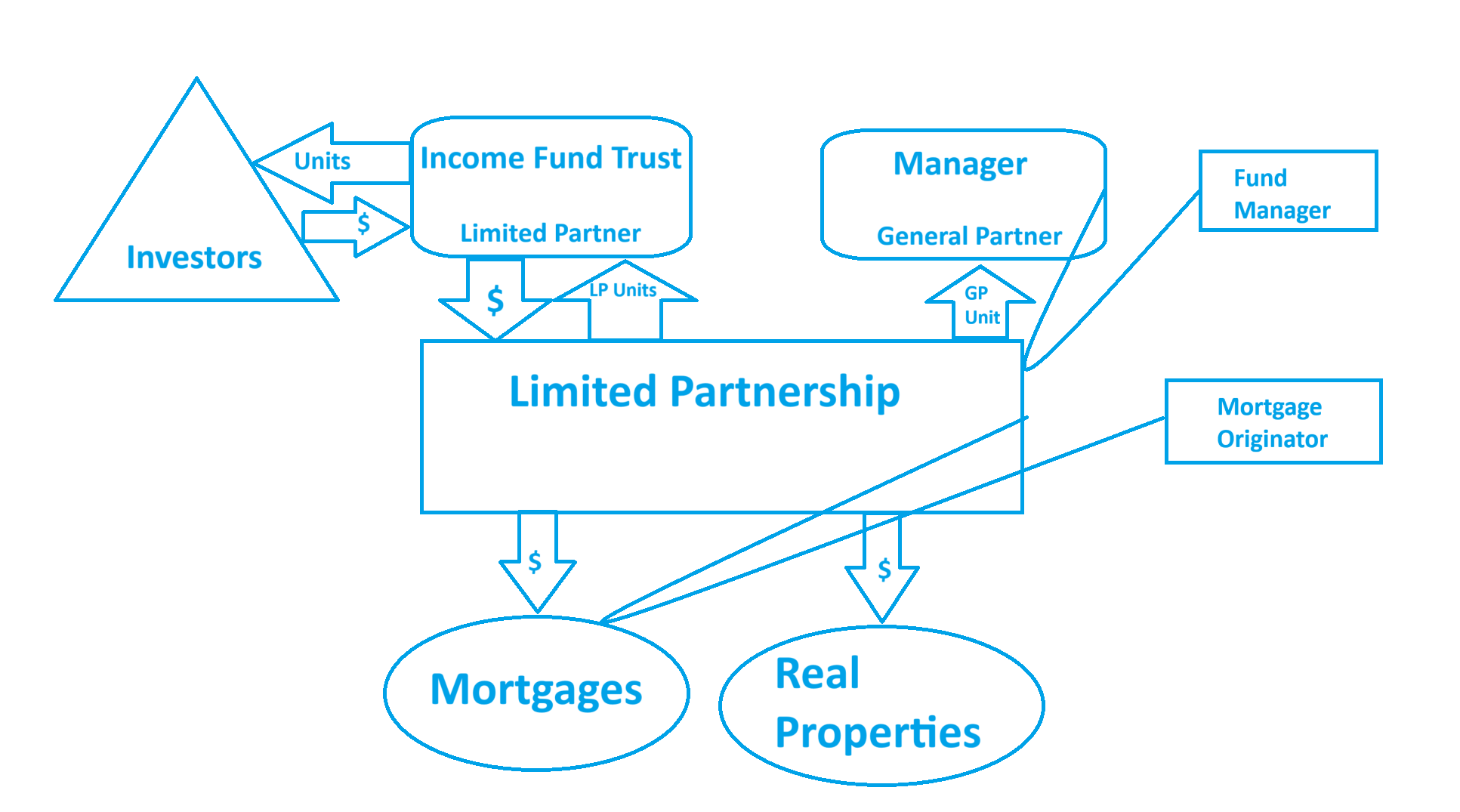

Mortgage Income Fund Trusts and Limited Partnerships

A Mortgage Income Fund Trust could be established to give investors an opportunity to invest, indirectly through units of a trust, in Canadian mortgages and other...

Do MICs need to file an exempt distribution report for shares issued under a DRIP?

Should a Mortgage Investment Corporation ("MIC"), include exempt distributions of shares or other securities issued under a reinvestment plan (i.e. a DRIP or Dividend Reinvestment Plan),...

Does your occupancy period count towards your 12 month anti-flipping of property?

Does your occupancy period count towards your 12 month anti-flipping of property? Bill C-32 makes a few simple changes to the Canadian Income Tax Act (the "Act")...

Can a lawyer act for both the lender and borrower?

In most conventional cases where the mortgage is not a "private" mortgage or loan transaction, there are no hard rules rather than good judgement and a...

A MIC’s Specified Shareholder, Related Persons and Prohibited RRSP Investment Considerations

The Question being asked is a brother or sister of a shareholder of a mortgage investment corporation (MIC) a specified shareholder (To qualify as a MIC...

MIC Foreign Investors & Withholding Taxes on Dividends

The Quick and Simple is that Yes, withholding taxes (usually 25% of gross amount unless subject to a tax treaty with the resident country of the...

Taxation of a MIC, a Mortgage Investment Corporation

The MIC itself will not pay income tax so long as the profits are flowed through to the shareholders and taxed in their hands. This is...

MICs: The Technical Aspects of a Mortgage Investment Corporation

TYPE OF ENTITY FOR A MORTGAGE INVESTMENT CORPORATIONA Canadian Corporation throughout the taxation year where its business only undertakes to invest its funds, and thereafter qualifies...

ESTATES & NFP: Income Tax and Family Law considerations at death

Income Taxes at DeathClaims arising on the death of a spouse are not many, nor is there much jurisprudence dealing therewith. But claims arising on marriage...