The Role of Estate Planning in Protecting Family Businesses

Family businesses are the backbone of many economies, providing financial stability and long-term wealth for generations. However, without proper estate planning, these businesses can face significant risks, from legal disputes to unexpected tax burdens. Estate planning ensures a smooth transition of ownership while protecting the business and the family’s financial legacy.

Why Estate Planning Matters for Family Businesses

Estate planning is more than just drafting a will—it’s about creating a structured plan to preserve and transfer business assets efficiently. Without a solid plan in place, family businesses risk:

✔️ Disputes Among Heirs – Without clear directives, family members may disagree over ownership and management.

✔️ Heavy Tax Liabilities – Estate taxes can take a significant portion of the business’s value if not planned properly.

✔️ Operational Disruptions – Sudden ownership changes can disrupt business continuity and decision-making.

By addressing these challenges proactively, estate planning provides clarity and security for the future.

Key Elements of Estate Planning for Business Owners

1️⃣ Succession Planning

A well-defined succession plan identifies who will take over the business when the current owner steps down or passes away. This process should involve legal documentation to formalize leadership roles and decision-making structures.

2️⃣ Buy-Sell Agreements

A buy-sell agreement establishes a plan for transferring ownership in case of retirement, disability, or death. It ensures that the business remains in trusted hands while providing financial protection to the departing owner’s heirs.

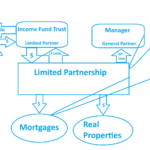

3️⃣ Trusts for Business Assets

Setting up a trust allows business owners to control how assets are distributed while minimizing estate taxes. A well-structured trust can protect the business from creditors and ensure it remains within the family.

4️⃣ Minimizing Tax Implications

Strategic estate planning helps reduce capital gains tax, probate fees, and other financial burdens. Business owners should work with legal and financial advisors to structure their estates in a tax-efficient manner.

5️⃣ Power of Attorney & Business Continuity

Granting power of attorney ensures that a trusted individual can make critical business decisions if the owner becomes incapacitated. This safeguards the company’s operations during uncertain times.

How Levy Zavet Lawyers Can Help

Navigating estate planning for a family business requires expert legal guidance to ensure a smooth transition of ownership, minimize tax liabilities, and protect against unforeseen challenges. At Levy Zavet Lawyers, we craft customized estate plans that safeguard your business and secure your family’s financial future. Whether you need assistance with succession planning, buy-sell agreements, or trusts, our team is here to help. Contact us today to protect your legacy: 416-777-2244 | Toll-Free: 1-877-777-8977 | as*@*******et.com.