Mortgage Income Fund Trusts and Limited Partnerships

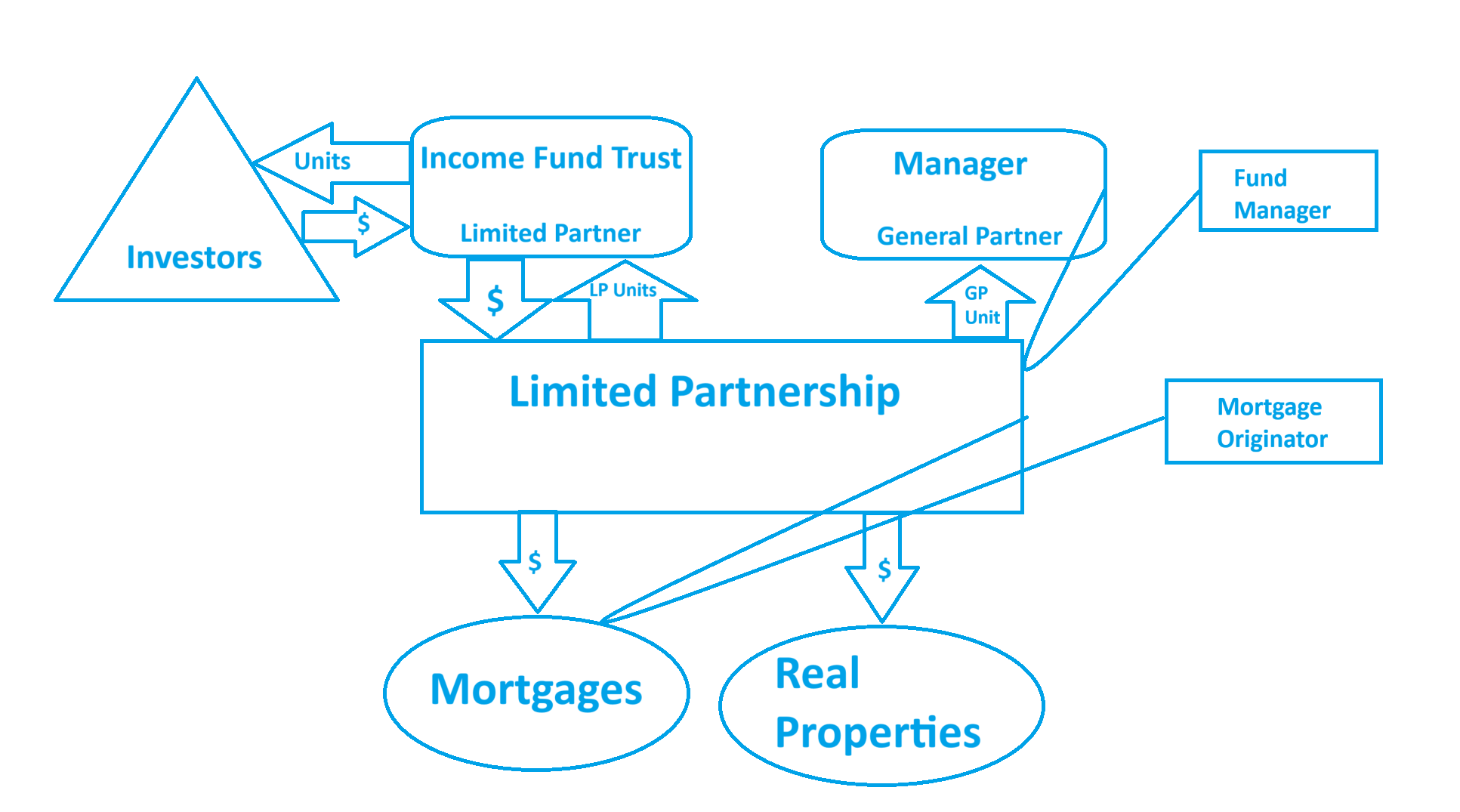

A Mortgage Income Fund Trust could be established to give investors an opportunity to invest, indirectly through units of a trust, in Canadian mortgages and other real estate opportunities originated by the Mortgage Originator and selected and determined to meet the Investment Objectives of the Fund by the Manager. The Fund could invest (indirectly through the Partnership) primarily in first position and subordinated Canadian mortgages secured by residential, office, industrial, retail, hotel and development land properties.

The Fund may also invest (indirectly through the Partnership) in real estate as well as secured consumer loans, the proceeds of which are used by the borrower to renovate or improve real property. The Fund should focus on preserving capital while providing stable and above market income.

The Mortgage Originator: is an established commercial mortgage originator providing service to private clients, primarily in the field of mortgage origination. The deal flow generated by the Mortgage Originator ensures a large selection of quality investment opportunities for the Fund to choose from.

Management: The Manager, the General Partner and the Mortgage Originator.

The Fund may have an offering of Class A Units and Class B Units on a continuous basis at the net asset value as of the applicable valuation date.

The Manager and The General Partner may be Ontario corporations.

All investment decisions must be approved by the Credit Committee composed of key individuals of the Fund.

Partnership: is a limited partnership formed under the laws of the Province of Ontario. The Partnership is a provider of real estate finance, and the sole limited partner of which is the Fund.

The Partnership is subject to the same investment objectives, strategies and guidelines as the Fund.

The Fund and the Partnership will be responsible for all their expenses including those relating to its establishment and ongoing operations. Such expenses include but are not limited to legal, audit, accounting, compliance, trustee, reporting, custodial, brokerage, finders, origination and various overhead expenses.

Distribution Reinvestment Plan: The Trustee of the Fund may establish a DRIP providing for the reinvestment of distributions payable to a Unitholder. Enrolment in the DRIP by Unitholders and the reinvestment of distributions payable to the Unitholder will be subject to the terms and conditions of the DRIP. The reinvestment of distributions will not relieve Unitholders of any income tax applicable to the underlying distributions.

Eligibility for Investment: Units of the Fund will be qualified investments for trusts governed by registered retirement savings plans, registered retirement income funds, deferred profit-sharing plans, registered education savings plans, registered disability savings plans and tax-free savings accounts provided that the Fund qualifies as a “mutual fund trust” or a “registered investment” within the meaning of the Income Tax Act (Canada). Holders of tax-free savings accounts, registered retirement savings plans, and registered retirement income funds should consult their own tax advisors to ensure that Units will not be a “prohibited investment” (as defined in the Income Tax Act and its regulations) in their circumstances.

Taxation of Unitholders: A Unitholder who is resident in Canada for the purposes of the Income Tax Act will generally be required to include in the Unitholder’s income for tax purposes for any year the amount of net income and net taxable capital gains of the Fund paid or payable to the Unitholder in the year and deducted by the Fund in computing its income.

The Fund, under certain circumstances, can expect that most of the income earned by it will be considered Active Business Income (ABI) for Canadian income tax purposes, instead of Interest Income. The ABI distributed by the Fund to investors who are Canadian Controlled Private Corporation (CCPC) should retain its character as ABI and therefore would not be included in the investors’ calculation of aggregate investment income.